While dining at a fancy restaurant years ago, I happened to overhear snippets of a conversation between two very chicly dressed woman at a neighboring table. One woman was complaining that she was tired of her lover showering her with jewels and expensive perfume when all she really wanted was a portfolio of stocks and bonds!

In some cases at least, it seems that diamonds are not a girl’s best friend. If you’re a guy and your significant other seems to be more practically minded rather than romantically inclined, then please read on because I have some terrific Valentine’s Day stocks for your security-minded gal.

The Valentine’s Day Portfolio

The most popular Valentine’s Day gifts are lingerie, perfume, jewelry, flowers, and chocolate. Listed below is my Valentine’s Day portfolio of US exchange traded stocks that will be sure to delight your loved one.

Lingerie: The 800 pound gorilla in this space is Victoria’s Secret, owned by Limited Brands (LTD). The company, incidentally, owns Bath & Body Works, a fragrance and spa specialty retailer. (This one company could kill two portfolio categories with one stone, but the perfumers merit their own mention.)

LTD clawed its way back from pre-recession lows hitting a new $35 high in December. The stock promptly tumbled and began consolidating. It was boosted out of its doldrums on February 3rd by blowing out January sales figures and raising Q4 guidance. Several days later, the stock pushed above $32 resistance and looks poised to test its next resistance at $34. The company will report earnings on February 23rd after the closing bell. It also pays a 2.4% dividend yield.

Perfume: Despite the fact that almost every perfume is now made with synthetic ingredients (of which many cause severe allergies and some are downright carcinogenic), women still plunk down dollars on scents. Of the publicly traded companies in this field, International Flavors & Fragrances (IFF) is by far the largest player–but is it the best?

Let’s take a look.

In its latest earnings report, the company said that increasing costs for raw materials plus increased R&D and marketing expenditures all took a bite out of the bottom line despite strong sales growth from emerging markets. In spite of this negative news, the company was upgraded the very next day but investor enthusiasm was dampened by an analyst at Morningstar who came out and said that the company faces numerous headwinds in the form of cost inflation and a fragile consumer spending environment that are likely to pose challenges for the company in the months ahead.

Enter the other two perfume players: Inter Parfums and Parlux. Inter Parfums (IPAR) reported better than expected third quarter earnings and analysts expect 14% growth in 2011, according to Zack’s. The stock is consolidating after flirting with its $20 all-time high in mid-December. It may just remain in its current holding pattern until it reports fourth-quarter earnings on March 9th.

In terms of market capitalization, the smallest member of this group is Parlux (PARL). But don’t let it’s small size fool you—technically, it’s been performing extremely well. It recently broke out of a long period of consolidation and is enjoying a strong upward trend.

Fundamentally, the company’s prospects are looking up. Its strengthening balance sheet boasts a strong cash position, no long-term debt, and a net book value of $4.94 per share (the stock is currently trading around $3.50). The company’s CEO cites a revised selling strategy and a dramatic reduction in operating expenses as the reasons for the marked improvement in operating income. He is predicting 2012 sales to be in the $145-$150 million range which is 16-25% above the 2011 fiscal year forecast.

Note that only IFF and IPAR pay dividends (1.9% for IFF; 1.4% for IPAR).

Jewelry: The two most compelling stocks in this area are Signet and Tiffany. Signet (SIG), whose brands include Kay and Jared, is the discount go-to jeweler of choice. Although it’s closed some of its bricks-and-mortar establishments, same store sales have risen. The stock is trading near its multi-year high of $45 which also happens to be an area of major resistance. If it can break through that, the next hurdle will be its all-time high at $50.

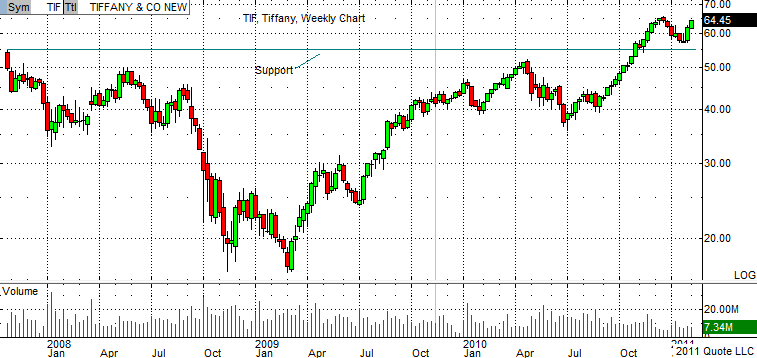

My favorite of the two is Tiffany’s (TIF). What woman doesn’t get weak in the knees when presented with a gift packaged in one of their signature blue boxes? Better than the box, though, is the company’s balance sheet which shows expanding growth in emerging market hubs especially the Asia-Pacific rim. It’s last quarterly report showed a 10% increase in same-store sales pointing to increasing strength in high-end consumer buying.

The stock hit its all-time high of $65 in mid-December and is looking to retest it soon. Unlike Signet, Tiffany does pay a dividend (1.5%) and it’s options field is much more robust.

The one negative mark against both of these companies is insider trading which has been very heavy in recent months.

Flowers: The only publicly traded company in this space is the internet floral and gift-basket retailer 1-800-Flowers (FLWS). On January 27th the company beat second quarter estimates citing improved margins. This announcement caused the stock to jump by 12%. Several days later, Zack’s added it to its #1 strong-buy list. Unfortunately, that did little for the stock which has been trading sideways since.

Overall, the stock price has been slowly rising. It has yet to face serious resistance in the $3.50 – $5.00 range which it hasn’t been able to top in over two years. The company also faces serious competition from Teleflora, FTD, and Amazon. Of all the stocks mentioned in this article, this one is the least compelling both technically and fundamentally.

Chocolate: Although Kraft and Cargill both have chocolate concerns, Hershey’s (HSY) is still the leader of the pack. The company’s Q4 report matched estimates but investors were cheered by the company’s cost-cutting program and successful commodity hedging which prompted an analyst at J.P. Morgan to up his price target to $54 from $50.

But the picture is not quite so rosy considering that the source of the product—cocoa—is under severe scrutiny by human rights activists. Most of the world’s cocoa is produced in West Africa using sweat-shop tactics while ignoring child-labor laws, and activists are encouraging the public to boycott chocolate this Valentine’s Day and send their own “Valentine’s” emails to Hershey’s urging that the cocoa they buy be certified free of abusive labor practices. How you feel about this is between you and your conscience and could be a real moral dilemma for die-hard chocoholics.

Technically, the stock has been channeling between $46 and $52 since last April. Before taking a long position, I’d wait for the stock to clear its channel high. This company also pays a dividend (2.7%).

Conclusion

So instead of the usual Valentine fare, consider the stock equivalent portfolio. It’s easier to purchase, much less fattening, and most of the stocks pay dividends. And what girl doesn’t like a gift that keeps on giving?